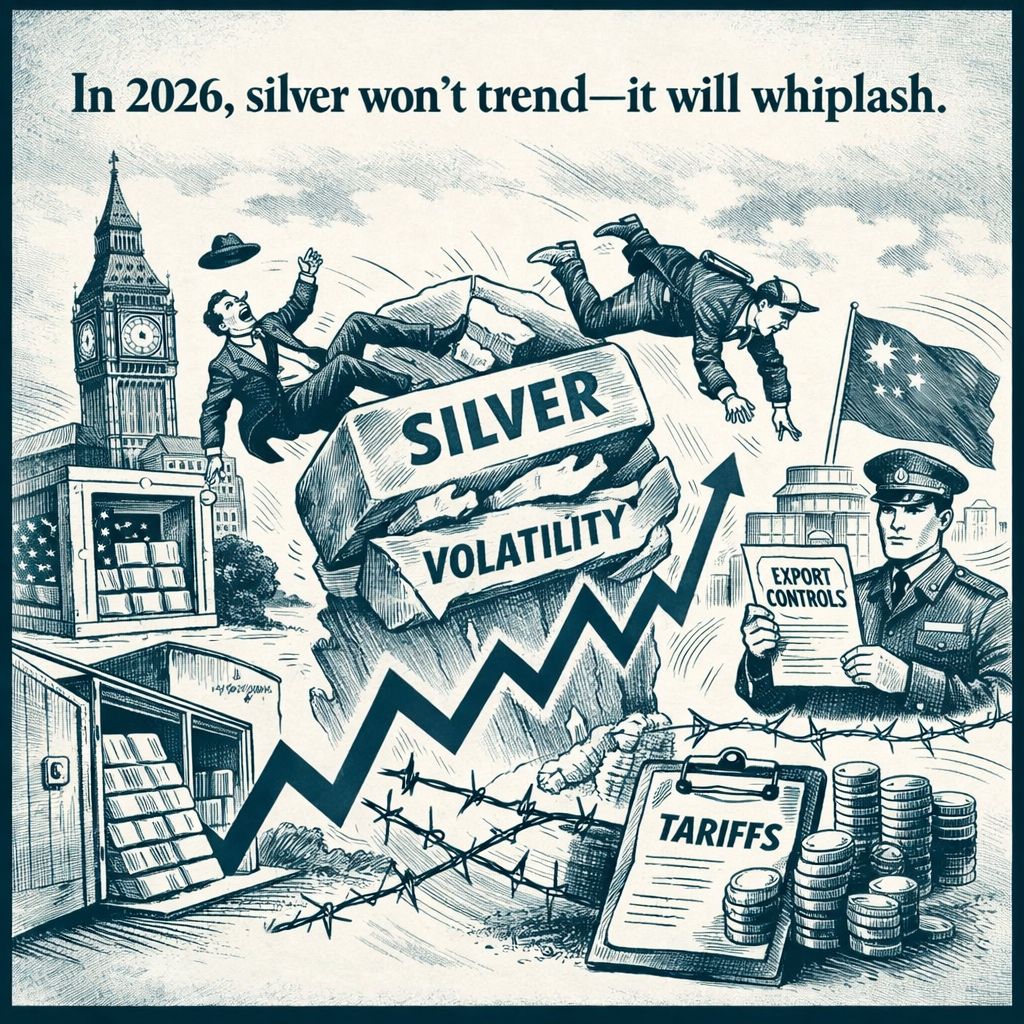

It may be violent in both directions not because the world has no silver, but because the metal is increasingly in the wrong places.

Goldman’s core point is simple: low London inventories (where the benchmark is set) make the market easier to squeeze, so price moves can overshoot fast and snap back just as hard.

What’s driving the turbulence:

1) It’s a location problem, not a global shortage

The “tightness” is concentrated in London after metal shifted into U.S. vaults amid tariff concerns.

2) Flows now hit harder

Goldman estimates that what used to move silver 2% (weekly net demand 1,000 tonnes) can now move it 7% in today’s thinner-inventory environment.

3) Policy risk keeps inventories fragmented

Even if tariff rules get clarified, silver may stay stranded regionally which keeps squeezes possible.

4) China adds another volatility layer

New export controls requiring approval for outbound shipments risk further market fragmentation, lower liquidity, and sharper regional price swings.

My takeaway:

If you treat silver like a smooth, global pool of supply, you’ll be surprised.

2026 looks more like a market of regional bottlenecks where volatility becomes a feature, not a bug.

What do you think dominates silver this year inventory location, policy/tariffs, or investor flows?

Full story: https://www.linkedin.com/in/pieter-borsje-28156185/